This post has been republished with updates since its original publish date of November 2011.

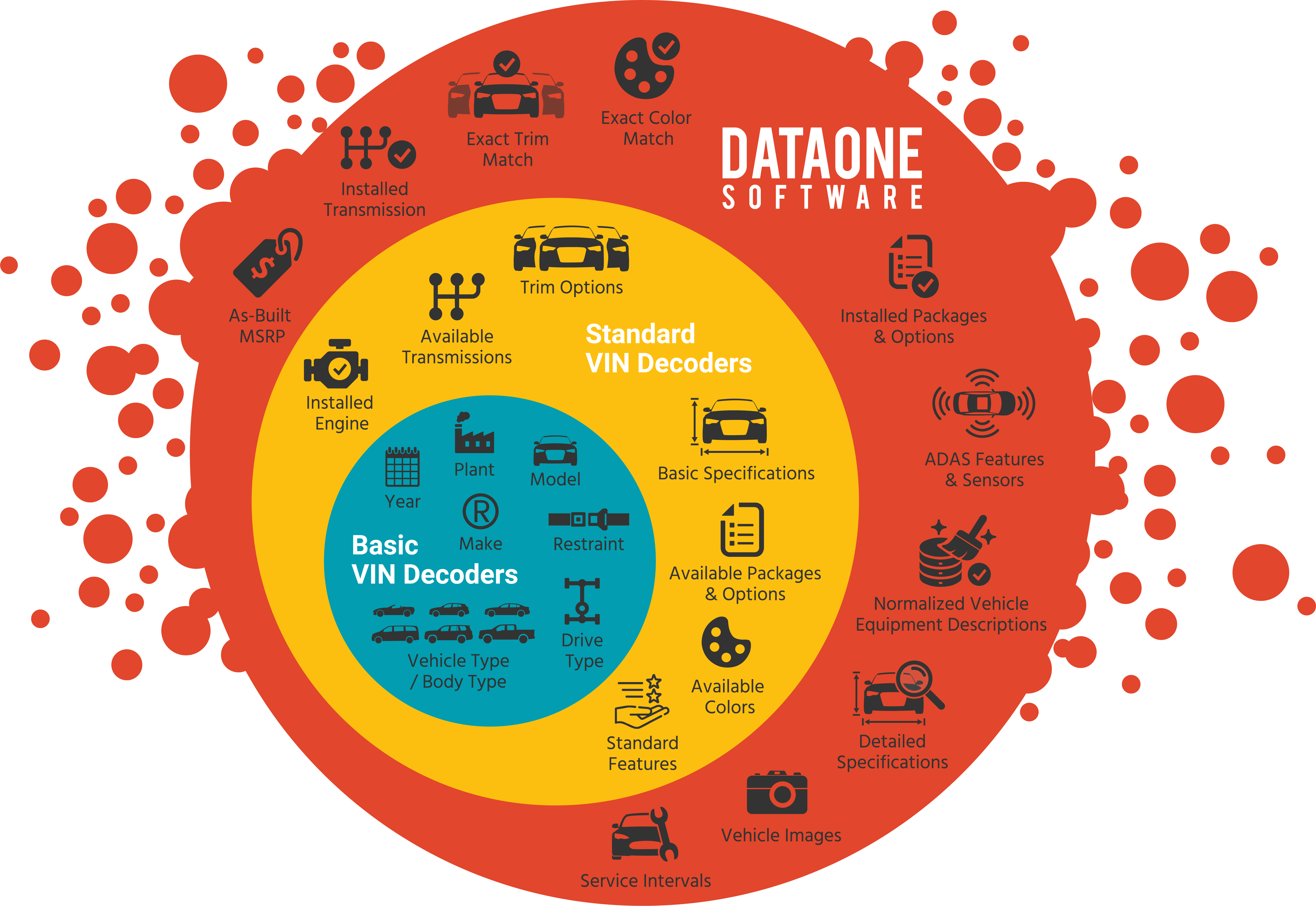

As you might expect, we get a lot of questions about VINs. There is a lot of confusion about what a VIN is, how it is used, what information is captured within it, and what is not. In this series, we hope to provide a good resource that you can use to educate yourself on Vehicle Identification Numbers (VINs) and VIN Decoding. The articles will progressively build from very basic and general information about VINs to more detailed and specific aspects of using them and vehicle data in business and technical settings. We hope you find them useful.

Read More