The auto insurance industry, after several years of experiencing unprecedented increases in loss ratio, managed to stem the tide in 2023 by posting a 104.9% mark, a 7% improvement from the prior year that still remains as a net loss. As these organizations continue to see business in the red, owner behavior is shifting in a manner that could easily see a return to loss increases. According to LexisNexis, high claim severity persists, and increased EV sales (up 54% year-over-year) could also inflate loss due to their increased susceptibility to total loss.

Vehicle technology is increasing in complexity besides EVs, and that complexity is a prime driver in added repair and claim costs. A recent AAA report that repairs focused on Advanced Driver Assistance Systems (ADAS) make up over 37.6% of repair costs after a crash. The industry-wide trend toward full vehicle automation is also fundamentally shifting risk from the driver to the car, and insurance risk modeling has not yet caught up to satisfactorily factor this in. McKinsey writes that this “connected revolution” in the automotive industry “means insurance coverage will likely need to shift from drivers to the automakers and software companies responsible for the development and maintenance of various autonomous-driving technologies.”

Recent Posts

Dec 18 2024

Dec 3 2024

The success of an e-commerce automotive parts platform depends on its ability to accurately convey the parts its customers need to complete their projects, but the automotive industry itself is making this easier said than done. Part returns are unfortunately a significant facet of their operations – the most recent National Retail Federation report showed that auto part returns are the most significant percentage of all returns in retail industries at 19.4%.

The frequency of parts returns is primed to only increase thanks to the worrying trend of parts proliferation; the significant expansions of vehicle trims in recent years, as well as new EVs, have led to enormous increases in the parts needed for effective service and repair. Lang Marketing, which released a study on this topic, has noted that “parts proliferation in the car and light truck aftermarket will soar for the foreseeable future, increasing inventories and the logistical burdens on manufacturers, distributors, retailers, and installers.” The necessity of a much larger parts inventory will naturally mean an increase in needed returns. The time needed to catalog this large volume of returns could disrupt businesses not prepared to handle it, possibly causing damage to your business’ brand and revenue flow.

Topics: Parts & Services

Oct 10 2024

Data security failures have become a paramount challenge for the automotive industry to address, with the CDK ransomware attack over the summer highlighting the far-reaching financial and reputational consequences of suffering a critical breach. According to threat intelligence provider SOCRadar, automotive businesses will continue to be an appealing target for cybercrime, because of the vulnerabilities inherent in necessary interconnectivity.

Read MoreTopics: Automotive Data, Operations, API

Jun 20 2024

Due to recent economic headwinds, auto insurance providers have had to prioritize profitability over customer acquisition, in order to reverse inflated loss ratios from the past several years. Consequently, as providers have raised rates across the board bynearly 26% in the past year, consumers have significantly increased their rate of policy shopping in an effort to find the best deal, with carrier switching increasing for six consecutive quarters.

Read MoreApr 4 2024

The auto insurance market in 2024 is not friendly to consumers. Providers, perhaps in an effort to mitigate rising loss ratio, have increased premiums by 26% in the past year, with plans for these costs to remain elevated through 2025. Consequently, consumers have flocked to auto insurance shopping sites and quoting portals to hunt for the provider that will impact their budget the least, with TransUnion noticing a 12% increase in shopping rates year-over-year in 2023.

The question for auto insurance lead generators and comparative raters is, beyond investing heavily in your market outreach (which is not guaranteed to succeed), how do you stand out as an exceptional product in a market that is both in demand and heavily saturated? How do you make your leads more appealing than your competitor’s leads?

Read MoreTopics: Insurance

Mar 8 2024

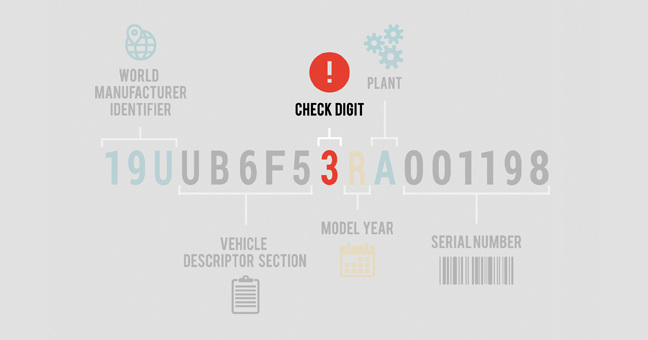

No manufacturing process is perfect, an obvious fact that the automotive industry knows too well, with nearly 900 recalls affecting over 34 million cars alone in 2023. No part of a car, truck, or trailer is immune from an error, and that includes the Vehicle Identification Number (VIN).

Read MoreTopics: Support, Automotive Data, API

Jan 4 2024

Warranty businesses serving the automotive industry are facing many of the same challenges impacting insurance companies, including price inflation for parts in both direct and 3rd party markets, supply chain roadblocks, and significant increases in claim severity. These issues are compounded by a pandemic-induced decrease in new car sales, all contributed to the warranty industry experiencing a 2.7% decline in revenue year-over-year per Consumer Affairs.

The good news for warranty companies is that there appears to be a clear path to rebound. The same Consumer Affairs report finds that consumers are increasingly looking to extend their cars’ usable lifespan and typically cannot afford costly repair bills without coverage. This points to an increased and sustained demand for warranty coverage as the population of vehicles in use ages. However, to maximize the profitability of these warranty policies, vehicle risk assessment models used to price warranties will need to be updated and future-proofed for the latest technology developments to maintain their accuracy.

Read MoreTopics: Risk Management, Warranty

Dec 5 2023

DataOne Software’s blog this year has emphasized the impact of increasing vehicle complexity within a wide swath of the automotive industry, and we are not going to be short on topics any time soon. The latest innovation that has captured the investment dollars of the tech sector, “AI” (which in truth is a mislabeling of the technology – it should more appropriately be called a Large Language Model) is now making its way into OEMs’ development plans, and automotive risk assessment professionals will need to closely consider its ramifications to avoid unexpected losses.

Read MoreTopics: Insurance, Automotive Technology, AI

Nov 28 2023

The economic conditions of the early 2020s had a unique impact on the automotive industry. Dubbed trimflation by car culture website Autopian, the output in entry-level models was greatly reduced, while high-margin trims became more commonplace and MSRPs were increased across the board. UMass Amherst Professor Isabella Weber noted, “Companies in the automobile sector [amplified] price pressures enabled by a form of temporary monopoly granted by the computer chip shortages. This allowed car producers to focus on expensive models with higher margins and generally raise prices without having to fear a loss in market share.”

Read MoreTopics: VIN, Insurance, Risk Management

Sep 14 2023

Electric Vehicle (EV) charging stations are a novelty right now, but in the United States, they will become both ubiquitous and a necessity in the next decade. The 2030 National Charging Grid Report finds 2.3 million charging ports will be needed to accommodate the 28 million EVs expected to be on the road by 2030, but as of right now, only 160,000 exist nationwide. This will be an enormously expensive venture – grid analytics company Kevala believes that California alone will need $50 billion to accommodate its EV and emissions targets.

Utility companies will have an unprecedented amount of financial capital, scope of work, and public pressure to adapt their service areas to the EV era. While not applicable to all the challenges inherent in this transition, curated, in-depth, and accurate vehicle data will be essential to develop optimal grid planning strategies.

Topics: Electric Vehicles